Being a travel nurse before founding Nurse First Travel Agency in 2017 I always felt travel nurses must know what their contracts entail and understand why they are structured the way that they are.

The financial side of being a travel nurse is critically important for those curious about the industry, and even those who already work as travel nurses. It can be a complex topic, but we’re going to break it down and help you better understand how contracts and payments work in the industry.

Why the bill rate is not as relevant as you think

A travel nursing contract typically includes two major components: a base salary and a per diem rate. Base salaries vary depending on location, experience level, and whether you are working at home or in a hospital setting. Per diems are generally paid twice a month — once for each week worked.

The bill rate is simply what the facility pays for each billable hour that a travel nurse works. Unfortunately, it is quite rare that the company sees every dollar of this because of these competing factors:

- Vendor Fees: a percentage of the hourly rate that the agency must pay the “middle man” who holds the contract. This applies only if it is not a direct contract with the facility

- Factor Fees: a percentage of what the agency invoices hourly to receive funds within a day or two as opposed to waiting upwards of +60 days for facilities to pay for your hours worked

- Unbillable Hours: Oftentimes, facilities will not pay — per their contract — the agency for your first set of hours worked in the contract; this can vary from 0 to 40 hours

Once these fees and deductions are taken from the bill rate, you then arrive at the Total Margin, from which the agency builds your pay package. This is where all pay packages start.

Example:

- Bill Rate = $100

- Vendor Fee = 5% ($5)

- Factor Fee = 2% ($2)

Unbillable Hours = 16 hours (if it is a 36 hr x 13-week contract that is a total of 468 hours that you are paid. The agency is only paid for 452 of those hours. Take 452 billed hours / 468 nurse paid hours and you see that the agency can only bill for 96.5% of the hours. Thus, another 3.5% (100%-96.5%) is lost from the bill rate for a total of another $3.50

To find the Total Margin, use this formula:

Yes, you read that correctly. Over $10 was lost before arriving at what the agency “sees” of the bill rate; i.e. the Total Margin. Think of this as the “Total Pie” and of this comes your “piece of the pie” as well as the agency.

The agency’s piece of the total margin pie

The first thing each travel nurse agency does once the total margin has been established is to take out their “piece of the pie” in what we refer to as the Profit Margin. This is the money used to keep their doors open and grow.

Let’s use Nurse First as an example. We take a 10% profit margin. Using the example above, here’s what the math looks like:

10% x $89.50 = $8.95 of each standard hour that the travel nurse works goes to Nurse First.

$89.50 – $8.95 = $80.55 is left for your pay packages and the salary burden that comes with paying you.

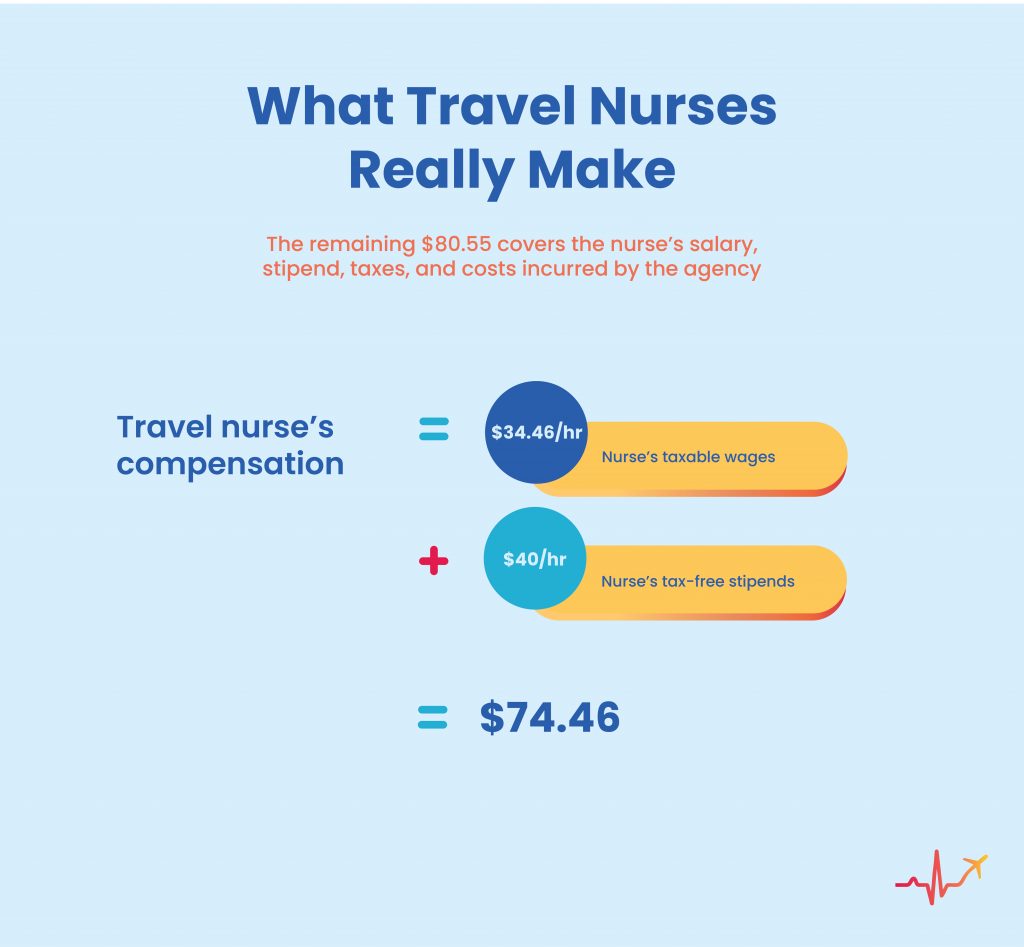

The travel nurse’s actual pay

Finally, we have arrived at the travel nurse’s actual compensation. Many sources lead many travel nurses to falsely believe that the travel nurse should receive all of the remaining pieces.

But the reality is that the remaining piece — $80.55 calculated in our example — must also cover these elements:

- The travel nurse’s taxable wages

- The travel nurse’s tax-free stipends

- The salary tax the employer incurs for paying the travel nurse

- The Worker’s Comp the employer incurs for paying the travel nurse

A total of $6.09 ($5.06 + $1.03) of the remaining “piece of the pie” is lost to taxes and worker’s compensation.

The salary tax required for employing the travel nurse is roughly 14.5% of the employee’s taxable wages, around $5.06 for the sake of this example. Roughly 3% of the employee’s taxable wages go to workers compensation.

These are deducted from the total “piece of the pie” and taken out before the worker’s gross salary is calculated, they are expenses that the company incurs for employing the nurse.

The reason these are not deducted from the agency’s profit margin is quite simple, the agency would only make $2.48/hr that the travel nurse works ($8.95 – $6.47= $2.48).

At Nurse First, we have costs of over $62k/mo. If we deducted those costs from our profit margin and only made $2.48/hr for every travel nurse who worked 36 hrs/week, we would need to employ 160 travel nurses just to break even.

After all of these deductions from the remaining piece of the pie are accounted for, a gross of $74.46/hr is left to go towards the travel nurse’s taxable wage and a tax-free stipend. This is about 75% of the initial bill rate.

Find Your Travel Nurse Pay Package Today

A travel nurse’s pay package is calculated by a combination of both agency costs, general business costs, and the losses incurred from the vendor and factor fees. This knowledge is essential for any travel nurse, or travel nurse hopeful because it shows where the money goes and why.

Before you sign a travel nurse contract, it is important to understand why an agency takes a certain margin, and what your actual payments will look like.

At Nurse First, we are passionate about everyone who works with us feeling clear about their contract and knowing exactly what to expect. Contact us today if you want to learn more about opportunities for travel nurses! Check out our job board for available travel nurse jobs in the top travel nurse locations!